Dear Shareholders and Friends,

Meeting Our Mission:

Clearinghouse CDFI provides economic opportunities and improves the quality of life for lower-income individuals and communities through innovative and affordable financing that is unavailable in the conventional market.

Featured Projects Borrowers

Impacts Since Inception

Committed to Creating Positive Impacts

1.8 Million

7,500 Units

20,000 Jobs

$1.73 Billion

600,000

Impacts In 2018

1 in 3

30 Homes

$8.3 Million

$65 Million

$26.5 Million

1 in 3

Our Team Staff

Douglas J. Bystry

President / CEO

Andrew Gordon

Arizona Market President

Brian Maddox

Chief Production Officer / Director of NV Operations

Jay Harrison

Chief Investment Officer

Kristy Ollendorff

Chief Credit Officer

Terrin Enssle

Chief Financial Officer

Alanna Smith

Director of Marketing

Alex Aguilar

Construction Loan Specialist

Amanda Virrey

Commercial Loan Processing Manager

Avery Ebron

Impact Lead

Cesar Plascencia

Office Coordinator

Chris McMartin

Opportunity Fund Manager

Colin Wegener

Assistant Controller

Debra Kramer

Construction Loan Specialist Manager

Gabriella Brusseau

Receptionist/Administrative Assistant

Guy Krikorian

Controller

Jatin Mehta

Sr. Accountant

Jesse Cruz

SoCal Market Representative

Julie Jongsma

Sr. Accountant

Justin Merlette

Assistant Loan Servicing Manager

Kathy Bonney

Director Business Operations/HR

Lacey Dixon

Loan Funder

Lauren Manalili

Commercial Loan Funder

Lawrence Chavez

New Mexico Market Representative

Lorey Louie

Portfolio Analyst

Lundi Chea

NMTC Asset & Compliance Manager

Melissa Brown

Portfolio Manager

Michelle Taylor

Loan Servicing Manager

Natasa Radosavljevic

Marketing Assistant

Pearl Curbelo

Production Assistant NV

Randy Dixon

Sr. Small Business Underwriter

Ricky Ha

NMTC Staff Accountant

Roscelle Shands

Commercial Loan Funding Manager

Sabrina Tran

Marketing Analytics Manager

Scottie Schindler

Sr. Commercial Underwriter

Sophia Barcelo

Loan Servicing Specialist

Taylor Lajoie

Assistant Commercial Loan Funder

Ted Chien

Underwriting Manager

Tyler Hagen

Collateral Specialist

Violeta Stolpen

Impact Writer & Analyst

Affordable Housing Clearinghouse (AHC)

Brenda Rodriguez

AHC Executive Director

Janell Abarca

Sr. Housing Counselor

Helen Tran

Housing Counselor

Board & Committee Partners In Our Mission

Gary Dunn - CHAIR Banc of California - Retiree

Alva Diaz Wells Fargo

Brian Riley State Bank of Arizona

Chris Walsh Partners Bank

Claudia Lima CIT

David Levy Fair Housing Council of OC

Glen Pacheco First Choice Bank

Jeff Talpas BBVA Compass

Kelvin James Bank of Hope

Lisa Dancsok Arizona Community Foundation

Mark Rebal Nano Banc

Pat Neal Neal Estate, Inc.

Robert McAuslan Western Alliance Bancorporation

Susan Montoya CRA Executive

Ray Nayar AOF / Pacific Affordable Housing - Retiree

Back Row Left to Right: Gary Dunn, Mark Rebal, David Levy, Brian Riley, Susan Montoya, Jeff Talpas, Chris Walsh, Claudia Lima, Glen Pacheco, Lisa Dancsok, Robert McAuslan.

Seated Left to Right: Kelvin James, Pat Neal, Alva Diaz.

Not Pictured: Ray Nayar

“My years of work with the Fair Housing Council of Orange County have made me realize that while housing is important, it alone is not sufficient to address issues of social and economic justice. For that, it takes access to opportunity. The community development made possible through CCDFI financing helps create that opportunity.”

– Dave Levy, Fair Housing Council of OC

Glen Pacheco - CHAIR First Choice Bank

Gary Dunn Banc of California - Retiree

Dino Browne Las Vegas Urban League

Laura Green First Foundation Bank

Melody Winter Head Federal Reserve Bank of San Francisco

Patricia Dixon CalPrivate Bank

Waheed Karim Banner Bank

Wesley Wolf Wolf & Company, Inc.

“Being on the Loan Committee as the community member allows me to work with a team of business professionals that have a common goal of providing quality loan underwriting services to the communities that Clearinghouse CDFI services.”

– Wesley Wolf, Wolf & Company, Inc.

Andrew Gordon - CHAIR Clearinghouse CDFI

Craig Williams Snell & Willmer

David Castillo Native Capital Access

John Prince Highland Financial Consulting

Jonathan Koppell ASU Watts School of Public Service & Community Solutions

Ken Burns Arizona Commerce Authority

Michael Lefever Wells Fargo

Paul Hickman Arizona Bankers Association

Tim Bruckner Alliance Bank of Arizona

“Arizona benefits greatly from community projects financed by Clearinghouse CDFI. Annual loan volume more than doubled since Arizona MultiBank combined with Clearinghouse CDFI in 2015. I’m also delighted that Clearinghouse CDFI brought $13.5M in NMTCs to Phoenix and the San Carlos Apache Indian Reservation.”

– Michael Lefever, Wells Fargo

David Levy - CHAIR Fair Housing Council of OC

Delores Brown CEDC, Inc.

Alan Woo Santa Ana Unidos

Andrew Michael Partnerships for Change

Gerald Sherman Bar K Management Company

Raymond Turner Temple Missionary Baptist Church

Stanley Tom Valley Small Business Development Corp.

Tim Johnson City of Federal Way

“My participation on the Advisory Board has enlightened me on the community development potential of Clearinghouse CDFI—one the most active and innovative lenders. I am fascinated and proud to be a member of the Advisory Board and look forward to the next impactful project.”

– Stanley Tom, Valley Small Business Development Corp.

Andrew Gordon - CHAIR Clearinghouse CDFI

Cyndi Franke-Hudson Wells Fargo

Edward Celaya Mutual of Omaha Bank - Retiree

Esperanza Martinez National Bank of Arizona

Lisa Van Ella State Bank of Arizona

Tim Bruckner Alliance Bank of Arizona

“I am very happy to be a part of Arizona Multibank, a division of Clearinghouse CDFI. Though Arizona Multibank has been active in Arizona for over 20 years, joining forces with Clearinghouse CDFI has allowed Arizona Multibank to increase lending and increase impact within our community. I am excited to see what the future will bring for these great companies and glad to be a part of the organization.”

– Tim Bruckner, Alliance Bank of Arizona

Gerald Sherman - CHAIR Bar K Management Company

Bob Crothers Citizen Potwatomi CDC

David Murray Native Capital Access

Karlene Hunter Native American Natural Foods

Shawn Nelson Father Sky & Mother Earth ART

Lenell Carter San Pasqual Tribe IPAI Community Loan Fund

“I thank Clearinghouse CDFI Native Advisory Board for allowing me the opportunity to participate in discussions and activities that assist underserved communities and I look forward to a very productive 2019!”

– Lenell Carter, San Pasqual Tribe IPAI Community Loan Fund

Glen Pacheco - CHAIR First Choice Bank

David Sharp Pacific Western Bank

Elsa Monte Pacific Western Bank

Joe Chen First General Bank

John Marder First Bank

Mark Rebal Nano Banc

Melinda Costa Wells Fargo

“It has been a pleasure to support the work of the Clearinghouse CDFI these past 14 years. Clearinghouse CDFI plays a very important role in providing credit for community development projects in the western region, and I am so proud to have been part of its growth.”

– Elsa Monte, Pacific Western Bank

Brian Riley - CHAIR State Bank of Arizona

Craig Kardokus First Foundation Bank

David Levy Fair Housing Council of OC

Michael Solomon Charles Schwab Bank

Steve Herman California Bank & Trust (Zions)

Susan Montoya CRA Executive

Rama Mohan Rao Amara State Bank of India

“It has been an honor to serve alongside my colleagues on the ALCO Committee for Clearinghouse CDFI. The ALCO Committee includes seasoned financial executives that provide the guidance and oversight needed to deliver more capital to underserved markets.”

– Steve Herman, California Bank & Trust (Zions)

Susan Montoya - CHAIR CRA Executive

Arturo Pérez U.S. Bancorp

Barbara Boone Western Alliance Bank

Bruce Gumbiner Cathay Bank

Gary Dunn Banc of California - Retiree

Joy Hoffmann Bank of the West

“I have supported many agencies over my career but I can say without a doubt that Clearinghouse CDFI has proven to be an agency of tremendous strength with razor-sharp focus achieving exceptional results. The staff and board of directors are the highest of quality and it has been a pleasure to support the mission of Clearinghouse CDFI for the last 20 years.”

– Susan Montoya, CRA Executive

In Memory of Mike McCraw

Our dear friend and long time NTMC Advisory Board member Mike McCraw passed away on December 25, 2018. Mike was a remarkable human being who was a trailblazer in community and economic development. He was the President and CEO of California Southern Small Business Development Corporation for 24 years, providing capital and opportunities to numerous small businesses throughout California.

Mike introduced Clearinghouse CDFI to Market Creek, our first ever New Markets Tax Credit project in 2002. Working with Joe Jacobs, Jennifer Vanica, and the Jacobs Foundation, he was relentless in obtaining long-term financing for this shopping center in a low-income area. Because of Mike’s leadership and our involvement, Market Creek became the premier example of how community development should occur.

Mike was an exceptionally committed and involved NMTC Advisory Board member for 14 years. He and Doug Bystry were brothers on both a professional and personal level with shared passions and a fond and deep friendship.

Mike will be greatly missed by all who knew him.

2018 Financial Information Selected Financial Highlights

2014-2018

2014-2018

Total Asset Size

Milestone: $510MM

Core Lending 2018

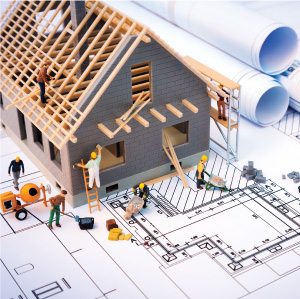

2018 Construction

Milestones

CCDFI Construction Lending: CCDFI funded a total of $36 million in 2018, 14.4% of the $250 million total

funded since inception.

Total Indivudals Served: CCDFI funded new construction projects serving over 20K individuals in 2018.

Construction Complete – Mesquite Library, Mesquite, NV: A new library branch and auxiliary learning center offer a hub for learning, careers, and events in this low-income community. CCDFI provided $10MM of NMTC allocation.

Construction Complete – CARE Community Center—Oakland, CA: Development of the new CARE Center allowed Lao Family Community Development to expand services for people facing homelessness and other challenges to reach 15K individuals annually. CCDFI provided a $7.67MM NMTC leveraged loan.

2018 Core

Milestones

CCDFI Opportunity Fund: Launched in 2018; Completed first investment in 2019—acquisition of vacant land in Los Angeles, CA for development into a 31-unit, multi-family apartment building including affordable units.

Capital Magnet Fund: CCDFI was awarded a $3.2MM grant from the U.S. Dept. of Treasury CDFI Fund to finance the development of affordable housing in CA, AZ, NV, and NM.

Financial Assistance Award: Clearinghouse CDFI was awarded $850K from the U.S. Dept. of Treasury CDFI Fund to sustain and expand financial products/services, with a focus on educational and vocational projects.

CDFI Bond Guarantee Program (BGP): CCDFI closed a $150MM bond—the largest, single bond loan to ever be originated through the U.S Treasury’s CDFI BGP, and CCDFI’s third issuance, for a total of $350MM.

2018 Healthy Food

Loan Milestones

CCDFI Food Related Lending: CCDFI funded $5.45MM in 2018 to provide healthy food access for minority communities located in food deserts. These loans serve 26K individuals.

FreshWorks Membership: CCDFI became a California FreshWorks member to help increase access to affordable, healthy food in low-income and underserved communities.

Project Spotlight – Red Lake Retail—Red Lake, MN: Development of a new retail center will provide products and services—including a larger deli and fresh produce—for members of the Red Lake Band of Chippewa Indians and local community. CCDFI purchased a $2.81MM participation in a $6.5MM loan.

Project Spotlight – Community Foods Market—Oakland, CA: Construction of a new supermarket will provide fresh food access and create 60 jobs in a low-income area that has been a food desert since the 1970’s. CCDFI purchased a $1.6MM participation in a $6.1MM NMTC source loan.

In Memory of CCDFI

Friend and Associate,

Alan Orechwa served Clearinghouse CDFI in many capacities throughout the entire 22-year history of our company. He was our longtime Board Chairman, Chief Financial Officer, as well as the senior member on our Loan, Asset Review, ALCO, and Arizona MultiBank Investment Committees. Alan had voted on, reviewed, or opined on, essentially every loan we made–totaling over $1.2 billion.

In 2012, Alan resigned from the board and became Clearinghouse CDFI’s Chief Financial Officer. As CFO, he led our finance, funding, and loan servicing teams. Alan contributed significantly to our executive team during a period of tremendous growth and geographic expansion.

Always the CPA, many of our corporate policies, practices, and operations can be attributed to Alan’s conservative and principled approach to running a financial institution. Yet, he also embraced our community focus and was extremely proud of our most impactful loans. Alan’s commanding presence and dry sense of humor meant he was both respected and well-liked in the office.

Alan was tenacious about continuing to work and contributing up until his final days. He could not have accomplished this without the tremendous assistance of his loving and devoted wife, Doris. A herculean effort was needed each morning just getting into their car.

They would then make the long trek from home to our office so that Alan could continue his responsibilities as CFO for the company he loved so much. Alan never complained nor wanted any sympathy from any of his co-workers. He was truly a role model for commitment, dedication, and a “never quit attitude”.

Clearinghouse CDFI owes much to Alan Orechwa. He was my personal mentor, friend, and a role model for 20-plus years. We have benefited greatly from, and relied upon, his wisdom and guidance. Thank you, Alan.

Alan will be profoundly missed.

-Douglas Bystry

Clearinghouse CDFI President/CEO

A Special Thanks to our Trailblazer Sponsor!