We're Going National

Dear Shareholders and Friends,

Meeting Our Mission:

Clearinghouse CDFI provides economic opportunities and improves the quality of life for lower-income individuals and communities through innovative and affordable financing that is unavailable in the conventional market.

-- Download the PDF: CCDFI 2019 Annual Report --

Featured Projects

Impacts Since Inception

1.9 Billion

21,500 Jobs

9,000 Units

1.9 Million

640,000

13,000

Impacts In 2019

1,000 Units

$5.84 Million

465 Units

65%

7,000

600 Students

$91 Million

Boards & Committees

Gary Dunn - CHAIR Banc of California - Retiree

Alva Diaz Wells Fargo

Brian Riley State Bank of Arizona

Chris Walsh Partners Bank of California

Claudia Lima CIT

David Levy Fair Housing Council of OC

Glen Pacheco First Choice Bank

Jeff Talpas BBVA Compass

Kelvin James Bank of Hope

Lisa Dancsok Arizona Community Foundation

Mark Rebal Nano Banc

Pat Neal Neal Estate, Inc.

Ray Nayar AOF / Pacific Affordable Housing - Retiree

Robert McAuslan Western Alliance Bancorporation

Susan Montoya Citizens Business Bank

Back Row Left to Right: Gary Dunn, Mark Rebal, David Levy, Brian Riley, Susan Montoya, Jeff Talpas, Chris Walsh, Claudia Lima, Glen Pacheco, Lisa Dancsok, Robert McAuslan.

Seated Left to Right: Kelvin James, Pat Neal, Alva Diaz.

Not Pictured: Ray Nayar

“As part of an organization that strengthens the economic fabric in our communities through product innovation and community service, I find that I am making a positive difference in the lives of the individuals, businesses, and communities CCDFI so passionately serves.”

– Glen Pacheco, First Choice Bank

Glen Pacheco - CHAIR First Choice Bank

Dino Browne Las Vegas Urban League

Gary Dunn Banc of California - Retiree

Laura Green First Foundation Bank

Patricia Dixon CalPrivate Bank

Waheed Karim Banner Bank

Wesley Wolf Wolf & Company, Inc.

“Realizing dreams by providing funding opportunities to businesses and communities where needed is what Clearinghouse CDFI delivers. I am proud and honored to have made a small difference in realizing those dreams. Thank you CCDFI for allowing my Loan Committee services.”

– Laura Green, First Foundation Bank

Andrew Gordon - CHAIR Clearinghouse CDFI

Cody Williams Maricopa County Justice Courts

Craig K. Williams Snell and Wilmer

David Castillo Native Community Capital

Douglas Bystry Clearinghouse CDFI

Elisa de la Vara Arizona Community Foundation

Jonathan Koppell ASU Watts College of Public Service and Community Solutions

Ken Burns Arizona Commerce Authority

Michael P. Lefever Wells Fargo

Paul Hickman Arizona Bankers Association

Tim Bruckner Western Alliance Bank

“As a member of the Arizona Board of Advisors, I enjoy being part of impactful community development lending in Arizona. I also appreciate Clearinghouse CDFI’s ongoing commitment to Indian Country in Arizona and nationally.”

– David Castillo, Native Community Capital

David Levy - CHAIR Fair Housing Council of OC

Alan Woo Santa Ana Unidos

Andrew Michael Partnerships for Change

Chris Francis CF Architecture Inc.

Delores Brown CEDC, Inc.

Gerald Sherman Bar K Management Company

Raymond Turner Temple Missionary Baptist Church

Stanley Tom Valley Small Business Development Corp.

Tim Johnson City of Federal Way

“CCDFI’s community development mission provides credit opportunities for projects and communities not being served by traditional financial markets. I value being a bridge between CCDFI’s NMTC Advisory Board and its governing board. The Advisory Board helps bring impactful projects in need of those opportunities to the attention of management, resulting in expanded social and economic justice in otherwise underserved areas.”

– David Levy, Fair Housing Council of OC

Gerald Sherman - CHAIR Bar K Management Company

Bob Crothers Citizen Potawatomi Community Development Corporation

David Murray Native Community Capital

Karlene Hunter Native American Natural Foods

Lenell Carter IPAI Community Loan Fund

Shawn Nelson Father Sky & Mother Earth ART

“I am honored to be part of CCDFI’s Native American Advisory Board. Membership has opened new doors and helped me accomplish additional goals. This includes becoming a board member of the Octavia Fellin Public Library in Gallup, NM, and plans to join additional state boards. Thank you!”

– Shawn Nelson, Father Sky & Mother Earth ART

Andrew Gordon - CHAIR Clearinghouse CDFI

Cyndi Franke-Hudson Wells Fargo

Edward Celaya Mutual of Omaha Bank - Retiree

Esperanza Martinez National Bank of Arizona

Kevin Halloran Mutual of Omaha Bank

Lisa Van Ella State Bank of Arizona

Terrin Enssle Clearinghouse CDFI

Tim R. Bruckner Western Alliance Bank

“I have enjoyed working on the AZ Investment Committee for Clearinghouse CDFI and AZ MultiBank for all these years. It is rewarding to serve in a capacity to assist business owners around AZ to get their financing needs met and allow them to grow and prosper.”

– Cyndi Franke-Hudson, Wells Fargo

Brian Riley - CHAIR State Bank of Arizona

Craig Kardokus First Foundation Bank

David Levy Fair Housing Council of OC

Michael Solomon Charles Schwab Bank

Rama Mohan Rao Amara State Bank of India

Steve Herman California Bank & Trust (Zions)

“It is such a privilege to serve on ALCO Committee and witness first-hand how Clearinghouse CDFI positively impacts our underserved communities.”

– Brian Riley, State Bank of Arizona

Glen Pacheco - CHAIR First Choice Bank

David Sharp Pacific Western Bank

Elsa Monte Pacific Western Bank

Joe Chen First General Bank

John Marder First Bank - Retired

Mark Rebal Nano Banc

Melinda Costa Wells Fargo

Wilson Mach First General Bank

“I’m honored to serve on Clearinghouse CDFI’s Asset Review Committee. Clearinghouse CDFI is an important partner for us and has a successful track record for balancing risk and impact in the communities they serve.”

– Melinda Costa, Wells Fargo

Susan Montoya - CHAIR Citizens Business Bank

Arturo Pérez U.S. Bancorp

Barbara Boone Western Alliance Bank

Bruce Gumbiner Cathay Bank

Gary Dunn Banc of California - Retiree

Joy Hoffmann Bank of the West

“Clearinghouse CDFI has had another successful year and continues to make an amazing impact on our communities. I am so honored to be a part of the Outreach Committee.”

– Barbara Boone, Western Alliance Bank

Looking Back

2019 Highlights

Opportunity Zones:

CLEARINGHOUSE CDFI CLOSES 1st CDFI-SPONSORED

PROJECT IN THE NATION

- $13.8 Million

- Los Angeles, CA – Koreatown

- 31-Unit Multi-Family New Construction Project

Best for the world

Using Business as a Force for Good, Clearinghouse CDFI’s honors include Best for Customers and Best

for the World: Governance, Changemaker, and Overall.

Ranked

58

Companies Around the World!

We were named among INC. 5000’s Fastest-Growing Privately Held Companies!

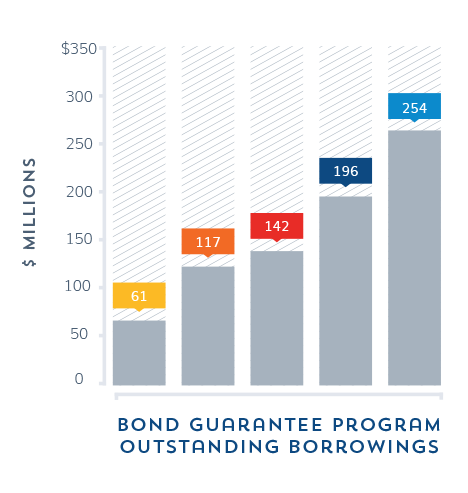

CDFI Fund Bond Guarantee Pledge Update:

CCDFI increased BGP borrowings by $64 million in 2019, ending the year at $254 million in outstanding borrowings from BGP. CCDFI has additional borrowing capacity of $79 million under the existing BGP allocation.

This year we launched our own

PODCAST CHANNEL!

Marvin Muy Luna

Rose Minsky

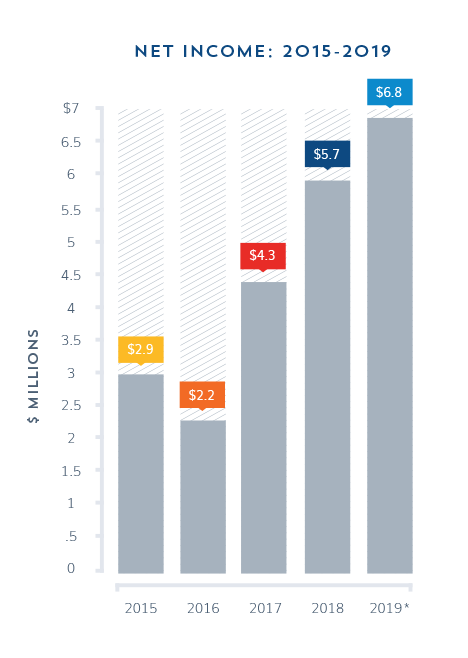

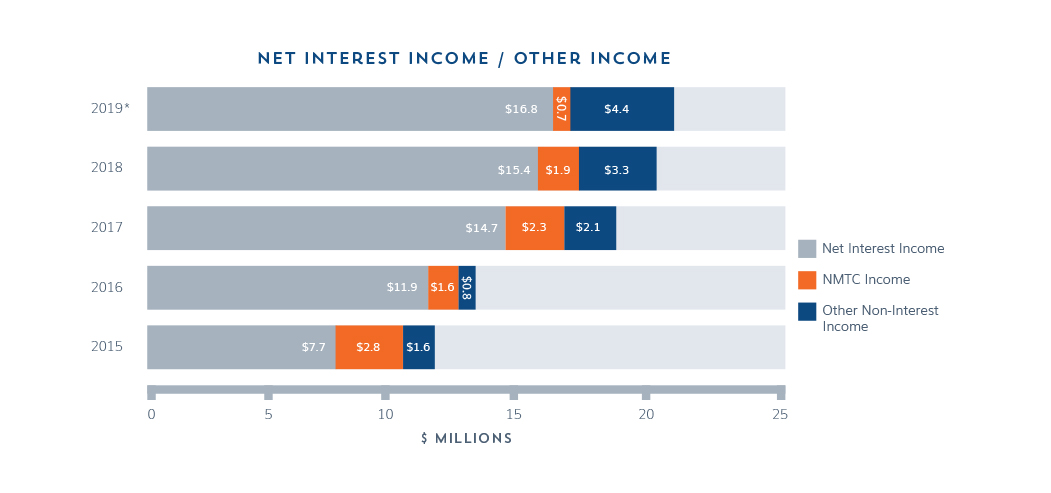

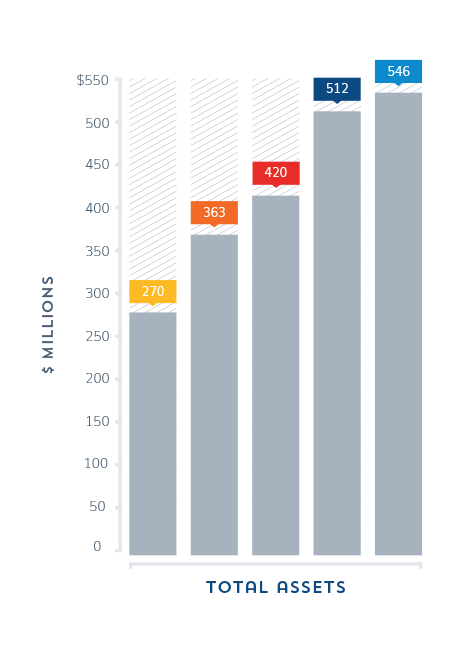

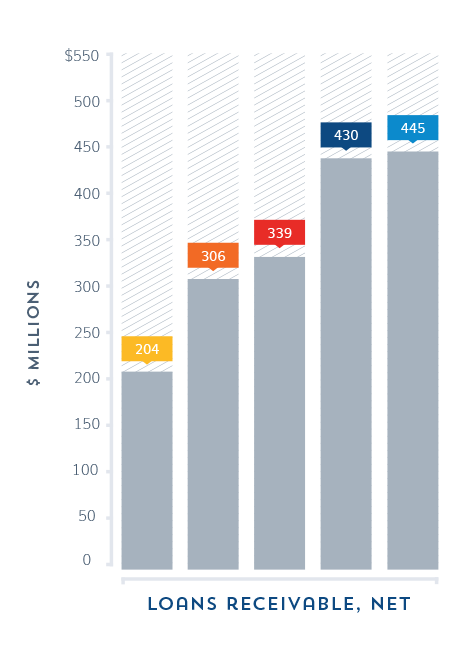

2019 Financials

Our Team

DOUGLAS J. BYSTRY

President / CEO

ANDREW GORDON

Arizona Market President

KRISTY OLLENDORFF

Chief Credit Officer

TERRIN ENSSLE

Chief Financial Officer

JAY HARRISON

Chief Investment Officer

Our Staff

ALANNA SMITH

Director of Marketing

AMANDA VIRREY

Commercial Loan Processing Manager

AVERY EBRON

Impact Lead

BRIAN SAGERT

Nevada Market Rep BDO

CESAR PLASCENCIA

Public Affairs Officer

CHRIS MCMARTIN

Opportunity Fund Manager

COLIN WEGENER

Assistant Controller

DEBRA KRAMER

Construction Loan Specialist Manager

DEIDRE WILLIAMS

Commercial Loan Processor

FERDUESI AHMED

CRE Portfolio Loan Analyst

GABRIELLA BRUSSEAU

Receptionist / Office Admin

GUY KRIKORIAN

Controller

JATIN MEHTA

Sr. Accountant

JUSTIN MERLETTE

Assistant Loan Servicing Manager

KATHY BONNEY

Director Business Operations

LACEY DIXON

Loan Processor / Administrative Assistant

LAUREN MCDONALD

Commercial Loan Funder

LAWRENCE CHAVEZ

New Mexico Market Specialist BDO

LOREY LOUIE

Portfolio Analyst

LUNDI CHEA

NMTC Asset & Compliance Manager

MAI HA

Impact Writer & Analyst

MELISSA JOHNSON

Director of Loan Operations

MICHELLE TAYLOR

Loan Servicing Manager

NATASA RADOSAVLJEVIC

Marketing Specialist

ORLANDO LOPEZ

Commercial Loan Processor

RANDY DIXON

Sr. Small Business Underwriter

RICKY HA

NMTC Staff Accountant

ROSCELLE SHANDS

Commercial Loan Funding Manager

SABRINA TRAN

Digital Marketing Manager

SCOTTIE SCHINDLER

Sr. Commercial Underwriter

SOPHIA BARCELO

Loan Servicing Specialist

TAYLOR LAJOIE

Assistant Commercial Loan Funder

TED CHIEN

Underwriting Manager

TYLER HAGEN

Collateral Specialist

Affordable Housing Clearinghouse (AHC)

BRENDA RODRIGUEZ

AHC Executive Director

HELEN TRAN

Housing Counselor

JANELL ABARCA

Sr. Housing Counselor

SHIPRA BHATIA

Program Coordinator

Staff Life

A Special Thanks to our

Trailblazer Sponsor!