CDFI Loans: Key Takeaways

- CDFI loans are structured financing provided by certified community development financial institutions.

- Approval depends on repayment capacity and a defined project purpose.

- Clearinghouse CDFI finances commercial real estate-based, community-serving projects nationwide.

- CDFI loans are one financing tool available for community-serving projects. The sections below outline how they are structured and who may qualify

Community Development Financial Institutions (CDFIs) operate at scale across the United States.

As of recent federal reporting, certified CDFIs collectively manage more than $450 billion in assets dedicated to community development financing.

CDFI loans are structured financing provided under defined underwriting standards and federal certification requirements.

These loans support commercial real estate-based and community-serving projects, with approval tied to financial viability and demonstrated repayment capacity.

In this guide, we’ll cover:

- What CDFI loans are and how they are defined

- Who typically qualifies for CDFI financing

- How CDFI loans are structured, including collateral and repayment expectations

- Common underwriting considerations and documentation requirements

- How CDFIs operate within the broader lending ecosystem

Who Qualifies for a CDFI Loan?

CDFI loans are available to borrowers undertaking eligible community-serving projects that meet defined financial criteria. In some cases, CDFIs finance transactions that require layered capital or alternative structures, provided repayment capacity is clear.

Eligible borrowers may include developers, nonprofit organizations, and businesses undertaking commercial real estate-based projects that serve a defined community purpose. Project types vary but generally involve income-producing or mission-driven community facilities.

These are the kinds of borrowers who typically benefit from CDFI financing:

- Small businesses with an operating history or real assets, such as owner-occupied commercial property or revenue-generating equipment

- Nonprofits with reliable revenue sources, including government contracts, service fees, or recurring donations.

Many CDFIs focus exclusively on business, nonprofit, or commercial real estate financing. Borrowers should confirm a lender’s specific focus before applying

How CDFI Loans Are Structured

CDFI loans support community-serving projects under defined underwriting standards.

Loan Purpose and Use of Funds

Most CDFI loans are tied to a defined project, such as the acquisition or improvement of commercial property. The stated use of funds must be clearly documented and consistent with the borrower’s operating plan.

Underwriting evaluates whether the proposed use of funds is consistent with:

- The way the project is structured

- How it will operate financially

- Its intended community purpose

Loan Size, Terms, and Repayment

Loan size and repayment terms are based on the scope of the project and how it is expected to perform over time.

In commercial real estate transactions, the loan amount generally aligns with the property’s value and its projected income. The loan term reflects the stage of the project and how long the asset will need to support repayment of principal and interest.

At closing, borrowers receive clearly defined payment terms, including principal and interest obligations. Approval depends on whether projected revenue supports consistent repayment throughout the life of the loan.

Asset-Backed or Cash Flow-Supported Structures

CDFI loans are typically supported by commercial real estate collateral and documented revenue projections.

For Clearinghouse CDFI, financing is secured by commercial real estate. The strength of the asset and its projected income are central to how the loan is structured.

Depending on the project, repayment may be supported by tenant leases, contracted revenue, or operating history tied to the real estate asset.

Underwriting and Risk Evaluation

Underwriting evaluates whether the transaction is financially sound and appropriately structured.

Lenders review the following:

- Financial statements

- Operating performance

- Sponsor experience

- Collateral value.

Income projections are assessed to determine whether repayment is sustainable over time.

Projects must meet eligibility requirements tied to community development, but approval depends on financial viability.

Finding CDFI Loans Near You

Finding the right CDFI loan often starts with identifying lenders that are federally certified and aligned with your project type.

National and regional CDFI directories can serve as a starting point. Each lender defines its own geographic focus, sector specialization, and minimum loan size.

Before applying, borrowers should review whether a lender serves their region and finances their specific type of project.

How to Choose the Right CDFI Lender

Once potential lenders are identified, alignment matters.

Borrowers should review whether the lender finances their type of project and whether the requested loan amount falls within the lender’s typical range. It is also important to confirm that the lender operates in the project’s location.

Before submitting an application, borrowers should understand what documentation will be required and how long the review process typically takes.

A clear fit between the project and the lender’s stated focus helps streamline the evaluation process.

While CDFI loans may differ from conventional bank loans in structure and eligibility criteria, both operate within defined underwriting frameworks. CDFIs are certified institutions with specific community development mandates. Their financing is structured to align capital with measurable project outcomes. As with any lender, repayment capacity and financial viability remain central.

Projects and Borrowers CDFIs Typically Do NOT Fund

CDFI loans are intended for financially viable, community-serving projects that fall within a lender’s defined scope.

The following are generally outside the parameters of most CDFI programs:

- Single-family home purchases or personal mortgages

- Projects without a defined operating plan or clear source of repayment

- Transactions outside a lender’s geographic or program eligibility area

- Applications that lack financial documentation

Each CDFI defines its own lending criteria. Reviewing those parameters in advance can help determine whether a project is a fit.

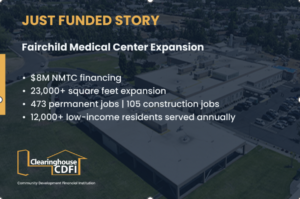

How Clearinghouse CDFI Approaches CDFI Loans

Clearinghouse CDFI finances commercial real estate-based, community-serving projects nationwide.

Our transactions are secured by commercial real estate and structured with defined repayment expectations. Each loan is supported by documented collateral and a clear operating plan tied to the property.

We frequently participate in layered financing structures alongside banks and other institutional partners. Projects must demonstrate financial viability and measurable community purpose.

Clearinghouse CDFI does not provide start-up financing or unsecured consumer loans.

CDFI Loans: FAQs

Still have questions about how CDFI loans work? You’re not alone. Here are the answers to some of the most common things borrowers want to know.

What are CDFI loans?

CDFI loans are provided by certified community development financial institutions to finance community-serving projects. These loans are structured with defined underwriting standards and repayment terms.

What is a CDFI business loan?

A CDFI business loan is a commercial loan provided by a federally certified Community Development Financial Institution (CDFI). These loans are typically used to finance commercial real estate or business-related projects that support economic growth and community development.

Clearinghouse CDFI finances commercial real estate-based projects and does not provide unsecured small business or consumer loans.

How do CDFI loans differ from traditional bank loans?

CDFIs operate under federal certification standards tied to community development objectives. Loan structures may vary based on program requirements, but repayment capacity and financial viability remain central to approval.

Are CDFI loans grants or forgivable loans?

No. CDFI loans are structured debt with defined terms and repayment requirements.

How does credit history factor into CDFI underwriting?

Credit history is one factor in underwriting. Lenders also review cash flow, collateral, operating performance, and how the transaction is structured. Past credit challenges do not automatically disqualify a borrower, but repayment capacity must be clearly demonstrated.

Are CDFI loans available for startup projects?

CDFI financing is typically provided to projects that demonstrate operating capacity and defined revenue projections tied to a commercial real estate asset. Clearinghouse CDFI does not provide start-up financing.

Do CDFIs offer personal or consumer loans?

Some CDFIs offer consumer products. Clearinghouse CDFI focuses exclusively on commercial real estate-secured financing for community-serving properties.

How do I find CDFI loans near me?

Certified CDFIs operate across the United States, and each institution defines its own geographic focus and lending criteria. Borrowers should review whether a lender serves their region and project type.

Clearinghouse CDFI finances commercial real estate-based projects nationwide

What are typical CDFI loan requirements?

Requirements vary by lender and loan type. Most applications include financial statements, a defined use of funds, and evidence that projected revenue supports repayment.