Meeting

Our Mission

Clearinghouse CDFI provides economic opportunities and improves the quality of life for lower-income individuals and communities through innovative and affordable financing that is unavailable in the conventional market.

Dear Shareholders

& Friends,

Featured Projects

The TERRA Network is a new fiber-optic microwave network under development by General Communication Inc. (GCI). Once complete, it will extend broadband Internet access to the remote villages of Kiana, Noatak, Deering, and Kotlik – an Alaskan Native Village Statistical Area.

Clearinghouse CDFI provided $10 million of NMTC allocation to GCI and will manage the funds through its subsidiary Community Development Entity (CDE). US Bancorp Community Development Corporation was the investor.

The new TERRA broadband network will deliver widespread education, healthcare, economic, and public safety benefits throughout rural Northwest Alaska. The project will also create 13 permanent jobs and 100 construction jobs paying a salary averaging 1.9 times the area living wage.

“GCI has delivered high-speed internet to some of the most remote locations on earth. Access to broadband can improve healthcare, education, and public safety. We are excited that our NMTC financing from Clearinghouse CDFI will help to extend this transformational service and bring economic opportunity to additional communities in Alaska.”

- Lewis Schnaper, Vice President of GCI Business

$10 MILLION OF NMTC ALLOCATION TO DEVELOP THE TERRA BROADBAND NETWORK, CREATING 13 PERMANENT JOBS AND 100 CONSTRUCTION JOBS

Pinoleville Pomo Nation is a Native American Tribe of 280 members living on a Rancheria near Ukiah, CA. Clearinghouse CDFI purchased a 90% loan participation which allowed the Tribe to regain a portion of its original Rancheria land.

As part of a unique financing partnership, the $2.24 million loan was originated by Indian Land Capital Company, a Native CDFI. It was further supported by Indian Land Tenure Foundation, a national organization helping American Indian nations recover their rightful homelands.

Pinoleville Pomo Nation’s purchase of the additional Rancheria land will help further tribal enterprises and provide for additional housing development.

"Clearinghouse CDFI's participation helped make land purchase within the Pinoleville Pomo Nation's jurisdiction possible. The land purchase will help with land development for housing and economic development for the Tribe."

- Leona L. Williams, Chairperson Pinoleville Pomo Nation

$2.24 MILLION LOAN TO PURCHASE LAND TO FURTHER TRIBAL ENTERPRISES AND ECONOMIC DEVELOPMENT

Lao Family Community Development (LFCD) helps refugee, immigrant, limited English, and low-income, U.S. born community members achieve financial stability and self-sufficiency.

"The CARE Community Center exemplifies our commitment to advancing the well-being of families, seniors, and youth. The strength and flexibility of Clearinghouse CDFI was what cinched the deal. Lao Family looks forward to a long-term relationship with Clearinghouse CDFI."

- Kathy Chao Rothberg, Executive Director of Lao Family

$7.67 MILLION LOAN FOR THE DEVELOPMENT OF A MULTI-PURPOSE CARE CENTER CREATING 118 JOBS

MSA Annex is a highly anticipated project which will further revitalize a low-income area of Tucson, Arizona. The new development is adjacent to Mercado San Agustin—a $2.24 million small business marketplace previously financed by Clearinghouse CDFI. Opening into downtown, the Annex will feature food and retail businesses constructed from converted shipping containers.

Clearinghouse CDFI provided a $2.7 million loan for construction of the Annex.

Once complete, MSA Annex will feature a children’s play area and a 500-seat, outdoor entertainment venue. Development of the Annex will create several construction jobs and help spur local economic growth and small business development.

“We are excited to complete MSA Annex, which is phase two of the Mercado San Agustin Public Market. It will help meet the need for local commercial business space as home to several maker-based businesses. It is also the newest entertainment venue, with an open-air festival grounds to host community events.”

- Adam Weinstein, Gasden Company President/CEO

$2.7 MILLION LOAN TO CONSTRUCT A NEW CENTER FROM SHIPPING CONTAINTERS FOR THE COMMUNITIES IN DOWNTOWN TUCSON

Walt’s “Do It Best” Hardware store has served the rural area of Holbrook, Arizona since 1964. This small business offers a “community-oriented” hardware experience at competitive pricing for local residents.

Clearinghouse CDFI provided $686,250 in financing for Walt’s Hardware to increase store inventory and boost business operations.

The only full-line hardware store within 30 miles, Walt’s can now continue its tradition of meeting all local hardware needs.

“We encountered difficulties with conventional lenders due to the unique circumstances of being in a rural area. However, the process with Clearinghouse CDFI went really quickly. Randy and Andy were great! Andy is truly a cheerleader for the rural area and underserved communities.”

- Amber Hill, Owner of Walt’s Hardware

$686,250 LOAN TO INCREASE THE INVENTORY AND OPERATIONS OF A RURAL, LOCALLY-OWNED HARDWARE STORE

Futuro Academy is a K-12th grade, tuition-free charter school operated by Charter Schools Development Corporation (CSDC) in East Las Vegas, NV. With a focus on extended classroom times and high-quality education models, Futuro Academy strives to prepare its students for a college education.

Clearinghouse CDFI provided $4.5 million in financing for the rehabilitation of a former shopping center into the new school facility with classrooms, administrative space, and a multi-purpose center.

The renovated building will allow Futuro Academy to expand enrollment to accommodate 116 students. This project will create 56 construction jobs and 8 full-time positions.

“The partnership with Clearinghouse CDFI allowed CSDC to continue to serve its mission of supporting new and early stage charter schools in low-income communities.”

- Laura Fiemann, CSDC, Senior Vice President

$4.5 MILLION LOAN CREATING A NEW SCHOOL FACILITY AND EXPANDING STUDENT ENROLLMENT

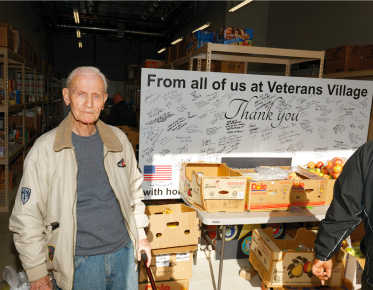

Veterans Village provides transitional and permanent housing for U.S. Veterans. Operated by Supportive Housing and Resources for the Elderly (SHARE), a Nevada nonprofit organization, Veterans Village is currently at 100% capacity with a lengthy waitlist.

Clearinghouse CDFI provided $5.6 million in financing for Veterans Village to acquire an additional 204 units of affordable housing. These units will be leased at a very affordable monthly rate to homeless veterans in this severely distressed area of Las Vegas, NV.

“I see our veterans suffering daily. This place wouldn’t be here without Clearinghouse CDFI. It has allowed me to improve my small part of the world. This message should be heard everywhere: Clearinghouse CDFI helps organizations like us to help other people.”

– Arnold Stalk, Executive Director, Veterans Village

$5.6 MILLION LOAN TO PROVIDE 204 UNITS OF AFFORDABLE, PERMANENT HOUSING FOR U.S. VETERANS

St. Paul A.M.E. Church is a place of worship with a long and culturally rich history of community engagement

and global outreach.

Clearinghouse CDFI provided $580,000 in financing to preserve St. Paul, its faith-based services, and local ministry.

St. Paul A.M.E. Church will continue serving over 2,500 parishioners in a socio-economically challenged area of San Bernardino, CA. This includes faith-based church meetings, prayer services, education, and social activities benefiting the severely distressed local community.

“Clearinghouse CDFI looked beyond the problems. They saw the need of this organization and our community. Clearinghouse CDFI opened doors because they shared our vision and believed in the people.”

- Reverend Norman D. Copeland, St. Paul A.M.E. Church

$580,000 IN FINANCING PRESERVE FAITH-BASED SERVICES AND LOCAL MINISTRY FOR OVER 2,500 PARISHIONERS

The Kalispel Tribe of Indians consists of 474 members who currently reside on the Kalispel Reservation in northern, rural Washington. Due to the remoteness of the reservation, tribal members must travel long distances to obtain basic amenities such as food and affordable fuel.

Clearinghouse CDFI provided $9 million of NMTC allocation for the development of a healthy foods grocery store, fuel station, and storage facility in Cusick, WA on Kalispel tribal land.

Once complete, the new 10,000 sq. ft. facility will provide easy access to healthy food options and affordable fuel for tribal members. The project will create 35 construction jobs and 20 full-time positions in this low-income community.

“The Kalispel Tribe supports and is actively involved in sustainable local economic development. The Tribe is focused on improving the regional economy. We are grateful for this exciting and innovative development that will add jobs and opportunity to the local economy.”

- Darren Holmes, Tribal Administrator & Tribal Council Member

$9 MILLION OF NMTC ALLOCATION CREATES 35 CONSTRUCTION JOBS AND 20 FULL-TIME POSITIONS

Impacting Communities

300 UNITS OF AFFORDABLE HOUSING TOTALING $34.2 MILLION IN 2017

40% OF LOANS TO ORGANIZATIONS WITH ENVIRONMENTALLY SUSTAINABLE EFFORTS IN 2017

$30 MILLION IN FUNDING TO NATIVE AMERICAN PROJECTS IN 2017

$38.5 MILLION IN NEW MARKETS TAX CREDITS DEPLOYED IN 2017

$1.55 BILLION IN CUMULATIVE LENDING

SINCE INCEPTION

500 LOANS TO NONPROFIT ORGANIZATIONS

SINCE INCEPTION

18,000 JOBS CREATED OR RETAINED

SINCE INCEPTION

10,750 STUDENTs CREATED OR RETAINED

SINCE INCEPTION

3 OUT OF 5 LOANS FUNDED TO WOMEN OR MINORITY OWNED ORGANIZATIONS IN 2017

1.5 MILLION TOTAL CLIENTS SERVED

SINCE INCEPTION

Our Team

Douglas J Bystry

Alan Orechwa

Andrew Gordon

Brian Maddox

Jay Harrison

Kristy Ollendorff

Alanna Smith

Amanda Virrey

Avery Ebron

Cesar Plascencia

Chris McMartin

Cindy Farney

Colin Wegener

Debra Kramer

Fathla Macauley

Guy Krikorian

Jan Hood

Julie Jongsma

Kathy Bonney

Kristin Graves

Lacey Dixon

Lauren Manalili

Lundi Chea

Lynese Briggs

Mai Nguyen Ha

Melissa Brown

Michelle Taylor

Natasa Radosavljevic

Pearl Curbelo

Randy Dixon

Ricky Ha

Roscelle Shands

Sabrina Tran

Scottie Schindler

Tyler Hagen

Affordable Housing ClearingHouse (AHC)

Brenda Rodriguez

Janell Abarca

Helen Tran

Our Partners

Board of Directors

-

Gary DunnBanc of California - CHAIRAlva DiazWells FargoCloyd PhillipsCommunity Services Agency - RetireeDavid LevyFair Housing Council of OCGlen PachecoProAmerica BankHenry WalkerFarmers & Merchants Bank of Long BeachJacky AllingArizona Community FoundationJeff TalpasBBVA CompassKeith ThomasRoyal Business Bank - RetireeKelvin JamesBank of HopeMark RebalNano Financial Holdings, Inc.Pat NealNeal Estate, Inc.Ray NayarAOF/ Pacific Affordable Housing - RetireeRobert McAuslanWestern Alliance BankSusan MontoyaFirst BankTerrin EnssleBanc of California

ALVA DIAZ“It has been with great pride and admiration that I have served on the Clearinghouse Board over the years. I have witnessed Doug and his team grow the organization into a multi-state capital provider. As an industry leader, Clearinghouse always views transactions through its mission-oriented lens, and is ever mindful of its

commitment to foster the greatest community impact.”

Not Pictured

Gary Dunn, Robert McAuslan, Henry Walker, Jacky Alling, Jeff Talpas, Kelvin James, Mark Rebal, Cloyd Phillips

CDFI Loan Committee

-

Glen PachecoProAmerica Bank - CHAIRAlan OrechwaClearinghouse CDFIDino BrowneLas Vegas Urban LeagueGary DunnBanc of CaliforniaLaura GreenFirst Foundation BankMelody Winter HeadFederal Reserve Bank of San FranciscoPatricia DixonPacific Premier BankWaheed KarimBanner BankWesley WolfWolf & Company, Inc.

PATRICIA DIXON“I have enjoyed working with everyone at Clearinghouse CDFI. They are instrumental in financing many worthy causes.”

Arizona Board of Advisors

-

Andrew W. GordonClearinghouse CDFI - CHAIRCraig K. WilliamsSnell & Wilmer LLPDouglas BystryClearinghouse CDFIDavid CastilloNative Capital AccessJohn V. PrinceHighland Financial ConsultingJonathan KoppellASU School of Public Service & Community SolutionsKen BurnsArizona Commerce AuthorityMichael LefeverWells FargoPaul HickmanArizona Bankers AssociationTim BrucknerAlliance Bank of Arizona

PAUL HICKMAN“After more than 25 years, Arizona MultiBank, a Division of Clearinghouse CDFI, remains a proud initiative of the Arizona Bankers Association.”

Community/NMTC Advisory Board

-

David LevyFair Housing Council of OC - CHAIRAlan WooSanta Ana UnidosAndrew MichaelPartnership for ChangeDelores BrownCommunity Development & AssociatesGerald ShermanBar K ManagementKarlene HunterNative American Natural FoodsMike McCrawR.M. McCraw & AssociatesRaymond TurnerTemple Missionary Baptist ChurchStanley TomValley Small Business Development Corp.Tim JohnsonCity of Federal Way

DELORES BROWN"After 21 years of providing financing opportunities to the underserved, Clearinghouse CDFI staff continues to commit to each transaction as if it's the first one. Our communities could not ask for a better partner."

Native American Advisory Board

-

Gerald ShermanBar K Management - CHAIRBob CrothersCitizen Potawatomi CDCDavid MurrayNative Capital AccessKarlene HunterNative American Natural FoodsLenell CarterIPAI Community Loan FundShawn NelsonFather Sky & Mother Earth ART

DAVID MURRAY"It is my pleasure to serve on the CCDFI Native American Advisory Board. I spent much of my life in Western Alaska and can attest to the transformative impact that investments like CCDFI’s NMTC allocation to the TERRA Network have on Native American and Alaskan Native communities."

Asset Review Committee

-

Glen PachecoProAmerica Bank - CHAIRDavid SharpPacific Western BankElsa MontePacific Western BankJohn MarderFirst BankLorena Mendez-QuezadaWells FargoMark RebalNano Financial Holdings, Inc.Terrin EnssleBanc of CaliforniaWilson MachFirst General Bank

JOHN MARDER“I have been impressed throughout my many years providing oversight as a member of the Asset Review Committee. Clearinghouse CDFI continues to maintain a high quality portfolio while making loans that banks simply would not make.”

Arizona Investment Committee

-

Andrew W. GordonClearinghouse CDFI - CHAIRAlan OrechwaClearinghouse CDFICyndi Franke-HudsonWells FargoEdward CelayaMutual of Omaha BankEsperanza MartinezNational Bank of ArizonaTim R. BrucknerAlliance Bank of Arizona

EDWARD CELAYA“I am proud to have been involved with the Arizona Multibank for over 20 years, now serving on the Arizona Investment Advisory. As a division of Clearinghouse CDFI, the combined resources provide additional benefit to Arizona communities. They have done a tremendous job of helping small and emerging businesses in Arizona over several years.”

ALCO Committee

-

Terrin EnssleBanc of California - CHAIRCraig KardokusFirst Foundation BankDavid LevyFair Housing Council of OCMichael SolomonCharles Schwab BankSteve HermanCalifornia Bank & Trust (Zions)Susan MontoyaFirst BankRama Mohan Rao AmaraState Bank of India

MICHAEL SOLOMON“It is a pleasure to work with such a sophisticated group of people who come together to ensure that Clearinghouse CDFI makes the most of the capital it has to benefit our communities.”

Outreach Committee

-

Susan MontoyaFirst Bank - CHAIRArturo PerezUS BankBarbara BooneWestern Alliance BankBruce GumbinerAmerican Business BankErik WaltersComerica BankGary DunnBanc of CaliforniaJoy HoffmannBank of the WestKeith ThomasRoyal Business Bank - Retiree

BRUCE GUMBINER“It is an exceptional occasion to be working with such a high quality group of individuals brought together by Clearinghouse in support of the outreach committee. It is a pleasure to be able to share the opportunities available as an investor in Clearinghouse with the community at large so that others can benefit from the organization’s mission.”

2017 Core Lending

Historically, Clearinghouse CDFI’s lending efforts have focused on housing and commercial lending.

However, 2017 saw an expansion into new areas of lending, including an increase in Native lending and healthcare facilities. Our lending in the healthcare field experienced a 92% increase over 2016.COMMERCIAL REAL ESTATE

& SMALL BUSINESS45%Includes:

- $37.5 million funded for assisted living/ skilled nursing and long-term healthcare facilities; includes a 44-bed facility for veterans in a low-income community

- All small businesses financed in 2017 are located in areas with unemployment >30% and poverty >20%.

COMMUNITY

DEVELOPMENT38%Includes:

- 265,000 square feet of community space rehabilitated or preserved

- 100% of loans for Native American projects will create/retain jobs for tribal members in areas with unemployment rates >30%.

HOUSING

DEVELOPMENT17%Includes:

- $34.2 million for 300 total units of affordable housing, including 31 units of low-income, deeply affordable multi-family homes

- 21 loans totaling $11 MM for physically disabled/special needs housing

2017 Financial Information