Clearinghouse CDFI, a certified Benefit Corporation, combines profit with purpose, positively impacting the community while maximizing financial benefits. By leveraging resources like Low-Income Housing Tax Credits (LIHTC), every project we finance creates measurable impacts that uplift borrowers and communities.

In this blog, we explore the symbiotic relationship between community development and financing through Low-Income Housing Tax Credits (LIHTC). We will take a dive deep into the world of LIHTC to learn how the program fosters affordable housing creation, revitalizes communities, and unlocks opportunities for individuals and families in need. Join us as we explore the What, Where, How, and Why of the LIHTC program.

What Are Low-Income Housing Tax Credits (LIHTC)?

Low-Income Housing Tax Credits (LIHTCs) are a type of federal tax incentive program in the United States that aims to encourage the development and preservation of affordable rental housing for low-income individuals and families. The LIHTC program was established in 1986 under the Tax Reform Act.

LIHTCs have been successful in promoting the development of affordable housing throughout the United States. They have become one of the primary sources of funding for affordable rental housing developments, increasing the supply of housing options available to low-income households (source: Urban Institute)

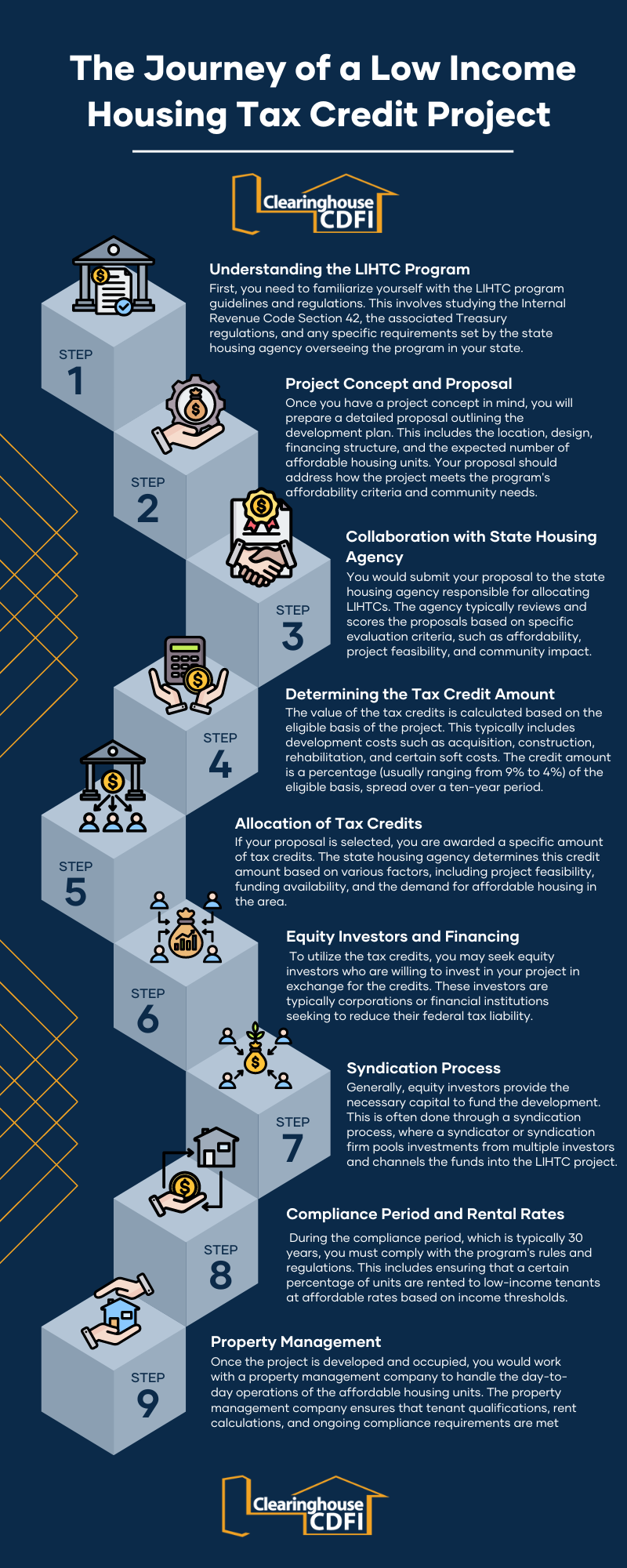

How Does the LIHTC Program Work?

Let’s explore the journey of a LIHTC project from start to finish for a developer interested in participating in the Low-Income Housing Tax Credit (LIHTC) program:

Throughout the process, you must maintain regular communication with the state housing agency, equity investors, and property management company to ensure ongoing compliance and successful implementation of the LIHTC program.

By leveraging LIHTCs and partnering with investors, you can secure the necessary funding to develop and maintain affordable housing projects, thus contributing to the availability of housing options for low-income individuals and families in your community.

Transforming Communities through LIHTC: Clearinghouse CDFI and Comite de Bien Estar

Comite de Bien Estar, Inc. (Comite) is a nonprofit community development organization dedicated to addressing the housing needs of migrant workers and low-income individuals in San Luis, AZ. Through its commitment to providing affordable housing solutions and vital social services, Comite has been empowering disadvantaged individuals since its establishment in 1977. A recent successful project undertaken by Comite, in collaboration with Clearinghouse CDFI, highlights their dedication to improving the lives of the community members.

The LIHTC Project:

In 2019, Comite developed a 92-unit, low-income apartment complex. This endeavor aimed to provide affordable housing options for individuals who face financial constraints and limited access to conventional financing. To realize this ambitious project, Comite secured $1.05 million in financing through Clearinghouse Community Development Financial Institution (Clearinghouse CDFI).

Clearinghouse CDFI’s Support:

Clearinghouse CDFI played a vital role in the success of Comite’s low-income housing project. We demonstrated our commitment to community development by providing the necessary financing to make the apartment complex a reality. This collaborative endeavor exemplifies the vital significance of partnerships between nonprofit organizations, multifamily developers, and financial institutions in addressing the pressing need for affordable housing solutions.

The Impact and Success of the LIHTC Project:

The successful completion of the 92-unit apartment complex marks a significant milestone not only for Comite de Bien Estar, but also for the community it serves. The LIHTC experts at Clearinghouse CDFI played a pivotal role in this affordable housing development in San Luis. Their profound understanding of the program allowed Comite to navigate the intricacies seamlessly and harness the full potential of LIHTCs. This collaboration stands as a testament to Clearinghouse CDFI’s commitment and competence in facilitating impactful affordable housing initiatives utilizing the LIHTC program.

The significant impact of this development on the well-being of the community, coupled with the effective utilization of LIHTC resources, solidifies Comite’s venture as an exemplary model of a successful LIHTC project. It serves as a beacon of hope and inspiration for future endeavors in the realm of affordable housing, highlighting the essential role played by Clearinghouse CDFI in making transformative housing solutions a reality.

Frequently Asked Questions about LIHTC

Q: What does LIHTC stand for?

A: LIHTC stands for Low-Income Housing Tax Credit.

Q: What is the purpose of LIHTCs?

A: The purpose of LIHTCs is to encourage the development and preservation of affordable rental housing for low-income households.

Q: How do LIHTCs work?

A: LIHTCs work by providing tax incentives to developers or investors who build or rehabilitate rental housing units that are affordable for low-income households. These tax credits can then be used to offset the investor’s federal income tax liability over a period of 10 years.

Q: Who administers LIHTCs?

A: LIHTCs are administered by state housing finance agencies (HFAs) in coordination with the Internal Revenue Service (IRS).

Q: Who is eligible to receive LIHTCs?

A: Developers or investors who meet certain criteria and commit to providing affordable housing for low-income households are eligible to receive LIHTCs. The specific income and rent restrictions vary by program and location.

Q: How are LIHTCs allocated?

A: LIHTCs are allocated to states based on population. Each state then determines its own method of allocating the tax credits to eligible projects, often through a competitive application process.

Q: Can LIHTCs be sold or transferred?

A: Yes, LIHTCs can be sold or transferred to other investors through syndication or other means. This allows developers to monetize the tax credits and generate funding for their affordable housing projects.

Q: What are the income and rent restrictions associated with LIHTCs?

A: LIHTCs require that a certain percentage of units in a project be rented to households with incomes at or below a specified income limit. Rent limits are also established to ensure affordability for low-income tenants.

Q: How long do LIHTCs last?

A: LIHTCs are typically claimed over a 10-year period. The tax credits are usually allocated annually, based on the qualified project’s eligible basis and the percentage of units designated as affordable.

Q: Are LIHTCs subject to compliance requirements?

A: Yes, LIHTC projects are subject to compliance requirements to ensure that the units remain affordable for the designated period. This includes income verification, rent restrictions, and ongoing monitoring by the state housing finance agency.

The Power of Affordable Housing

Affordable housing serves as the cornerstone of vibrant and inclusive communities. It is not merely a place to live; it is a catalyst for positive change. By addressing the critical need for affordable housing, we can unlock a myriad of benefits that extend far beyond shelter. Stable housing creates stability in other areas of life, enabling individuals and families to focus on personal growth, education, and career advancement. It fosters community connections, social cohesion, and a sense of pride in one’s neighborhood.

Affordable housing developments are not standalone ventures; they have the potential to reshape the fabric of an entire community. As new housing opportunities arise, the demand for local goods and services increases, benefiting businesses and driving economic growth. A thriving community attracts investment, fosters collaboration, and enhances the overall quality of life for all residents.

Can LIHTC Help Your Community Thrive?

In every community, there lies untapped potential for growth, progress, and collective well-being. We often find ourselves wondering how we can contribute to the betterment of our local areas and create a lasting impact. Today, we invite you to reflect on this extraordinary opportunity that can ignite positive change in your community – the development of affordable housing through the LIHTC program. As we delve into the possibilities of affordable housing and its potential to shape our communities, let us explore the transformative role Clearinghouse CDFI can play as your trusted partner in community development financing.

What if we could reimagine our community by embracing affordable housing development as a catalyst for growth, prosperity, and enhanced well-being?

Imagine a community where everyone, regardless of their income level, has access to safe, stable, and affordable housing. Picture families thriving in neighborhoods that foster a sense of belonging, where children can grow, learn, and dream big. Consider the ripple effects of revitalized areas, where affordable housing projects create jobs, attract businesses, and breathe new life into the local economy. Now, ask yourself: What impact could a LIHTC project have on our community?

Clearinghouse CDFI: Your Partner in Community Development Financing

When it comes to community development financing, Clearinghouse CDFI stands out as a trusted partner committed to making a difference. With a proven track record of success, Clearinghouse CDFI offers comprehensive support and expertise in navigating the complexities of the LIHTC program and other community development initiatives. Our team of experts understands the unique challenges and opportunities that come with affordable housing development, ensuring that your project is met with tailored solutions and unwavering support.

Ready to transform your community through the power of affordable housing?

Whether you are embarking on a LIHTC project or have other community development financing needs, Clearinghouse CDFI is here to guide you every step of the way. Don’t miss out on the opportunity to create a lasting impact on your local area.

Contact us today and let Clearinghouse CDFI and LIHTCs work for YOU!