Though CDFIs have been around for several decades, questions like “what is a cdfi?” and “are cdfis legitimate?” show up as search queries hundreds of times each month. Most people understand what a bank or credit union is because they trust them with their own personal finances.

But what happens when your local charter school wants to expand enrollment for low-income minority children? They will need to purchase a new building or make renovations to their current one, and typically, these major projects require financing of some kind. What if they have no bank relationship or no prior credit history?

This is the part where a CDFI steps up to help make dreams come true.

For a quick overview on what CDFI's are, listen to Episode 1 of Funded! by Clearinghouse CDFI

CDFIs Defined

CDFI stands for Community Development Financial Institution. Opportunity Finance Network defines CDFIs as “lenders that provide fair, responsible financing and services to rural, urban, Native, and other communities that mainstream finance does not traditionally reach.” These are mission-driven organizations that aim to promote economic and community development.

CDFIs come in many forms including credit unions, banks, loan funds, and venture capital funds. They typically offer loans, investments, and other financial services that are tailored to meet the unique needs of the communities they serve.

CDFIs are important for several reasons:

- Promoting Economic Development: CDFIs help promote economic development and job creation by providing funding for projects in underserved communities. This helps reduce poverty and improve the community’s overall well-being.

- Supporting Small Businesses: CDFIs often focus on providing loans and investments to small businesses, which can be a key driver of economic growth. By supporting these businesses, CDFIs help create jobs and stimulate local economies.

- Filling a gap in the financial market: CDFIs often provide financial services that are not readily available through traditional banking institutions. This can include loans for affordable housing, community facilities, and other community development projects.

Overall, CDFIs play an important role in expanding access to affordable financial services and promoting economic development in underserved communities.

Regulation

CDFIs were created in the United States in the 1990s as a response to the lack of access to credit in many low-income and minority communities. They are certified by the U.S. Treasury’s CDFI Fund, which provides financial and technical assistance to help CDFIs promote economic revitalization and community development.

Typically, a CDFI becomes certified by the CDFI Fund after demonstrating their commitment to serving underserved communities and meeting certain eligibility criteria. CDFIs operate under strict regulations and reporting requirements, and they are subject to audits and other oversight measures to ensure that they are fulfilling their mission.

First Responders

CDFIs are often considered the first responders in an economic crisis. In emergencies like 9/11, Hurricane Katrina, and the 2008 financial crisis, CDFIs were the first line of defense for many companies and individuals.

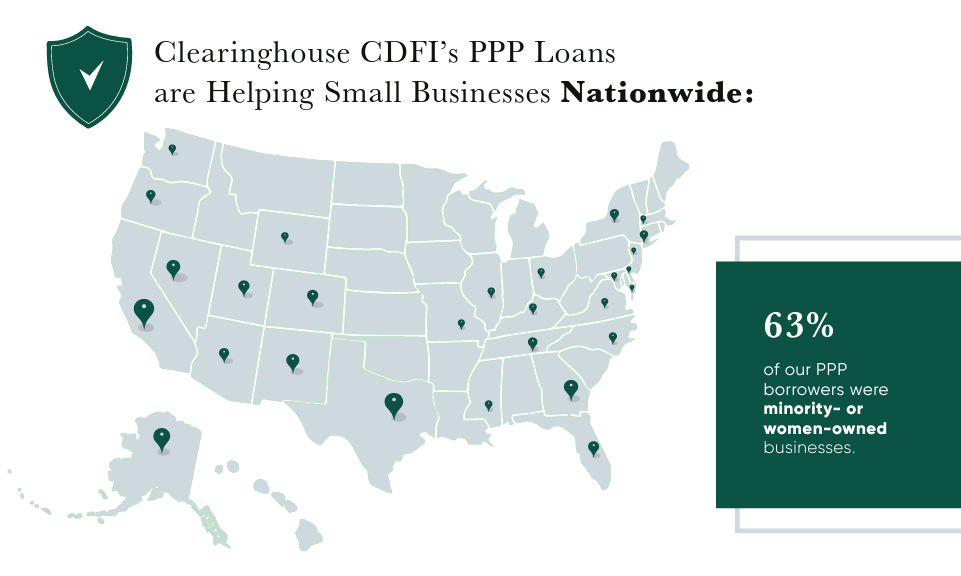

During the COVID-19 pandemic, many small businesses faced significant financial challenges and struggled to access funding through traditional lenders. Many companies faced catastrophic economic failure with nowhere to turn. Women and minority-owned business were hit the hardest despite emergency funding such as the Paycheck Protection Program (PPP). Flaws in program parameters led experts to fear that nearly 90% of minority and women-owned businesses could be shut out of the PPP program.

CDFIs were able to quickly pivot their operations and deploy PPP funds to small businesses in their communities. Through more personalized support and guidance to borrowers, CDFIs helped navigate the PPP application process, ensuring each business met the program’s requirements.

CDFIs utilized their ability to reach businesses overlooked by larger financial institutions. Since they have experience working with businesses without established credit histories, CDFIs were able to provide PPP loans to those who may have lacked existing relationships with banks.

Clearinghouse CDFI was one of the several CDFIs who stepped up to the plate to offer PPP loans to underserved communities.

Clearinghouse CDFI PPP by the Numbers |

|

Clearinghouse CDFI

Clearinghouse CDFI (CCDFI) is a mission-driven lender headquartered in Lake Forest, California. We provide full-service, direct lending for projects that create jobs and services that help people work, live, dream, grow, and thrive in healthy communities.

Established in 1996, CCDFI began in Southern California but we have since expanded throughout the U.S. with a focus on California, Nevada, Arizona, New Mexico, Texas, and Indian Country.

CCDFI believes that every borrower and every project is unique. From construction and renovation to acquisition and refinancing, we consider each loan individually and work to determine tailored terms to meet the needs of each distinctive project. We analyze every loan application with consideration for its potential impact and return. All our loans provide measurable community benefit.

|

|

CCDFI is also a Certified B Corp. B Corps are socially and environmentally sustainable companies that have been certified by B Lab as meeting high levels of performance, accountability, and transparency. Those companies that have been certified as B Corps are continuously governed and their impact measured by B Lab. This ensures that each B Corp company continues to hold themselves accountable to meeting these high standards. Each year B Lab recognizes the top-performing B Corps across the globe. B Lab has recognized CCDFI as Best for the World 5 years in a row! |

As a B Corp and for-profit CDFI, we are proud to uniquely position ourselves with a bilateral approach to measure success: maximizing profits while maximizing returns to people and the planet!

Check out some of our recently funded projects:

|

Middle College High SchoolGallup, New Mexico |

|

|

Mountain Timber EstatesKerby, Oregon |

|

Hand Up MinistriesOklahoma City, Oklahoma |